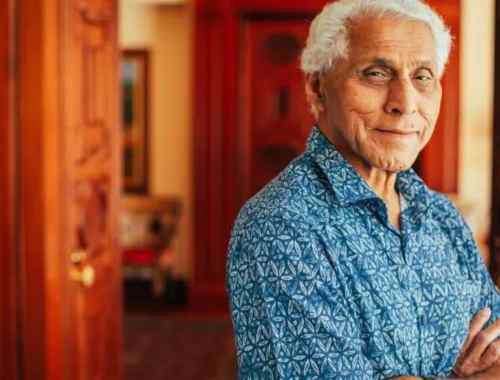

BYJU’S Faces Crucial EGM – In a high-stakes showdown, the fate of India’s edtech giant BYJU’S and its founders, Byju Raveendran and Divya Gokulnath, hangs in the balance as the company gears up for an Extraordinary General Meeting (EGM) scheduled for Friday. The event is poised to shed light on a series of critical issues that have plagued the company for the past two years, pitting the management, including CEO Byju Raveendran, against a group of key shareholders.

BYJU’S Faces Crucial EGM : A Deep Dive into Key Issues and Investor Concerns

EGM Dynamics and Management’s Response: A day before the EGM, BYJU’S management, facing pressure from a group of shareholders, announced that neither CEO Raveendran nor other board members would attend the EGM, deeming it invalid. However, sources within the investor group assert that the EGM will proceed as planned, with resolutions set for voting.

Investor Concerns and Key Questions: Inc42 has obtained a copy of the notice for the EGM, dated February 1, 2024, highlighting concerns on various fronts, including alleged deteriorating financial and corporate governance conditions.

- Leadership Change: Shareholders are pushing for the removal of CEO Raveendran, co-founder Divya Gokulnath, and board member Riju Ravindran. The investor group cites mismanagement and failures, seeking a change in leadership to prevent further dilution of value.

- Financial Mismanagement Allegations:

- Investors demand answers regarding alleged contraventions mentioned in show cause notices by the Enforcement Directorate (ED) in November 2023.

- Concerns include the company’s failure to resolve issues with Term Loan B (TLB), resulting in an insolvency plea.

- Allegations of misleading shareholders on various financial matters, including delayed audited financials and payments of statutory obligations.

- Value Erosion and Dues Collection Failures:

- Management accused of failing to recover approximately INR 1,400 Cr of billings from an affiliated reseller in Dubai (More Ideas General Trading LLC).

- Questions raised about the management’s failure to enforce the company’s rights against Blackstone entities and Mr. J.C. Chaudhry.

- Investors seek clarity on the prolonged uncertainty around Aakash Institute, for which BYJU’S reportedly paid nearly $1 Bn.

- Concealment of Material Information:

- Allegations of management’s failure to disclose a notice of default from Great Learning in April 2022 and consequences affecting the group’s value.

- Questions raised about the transfer of funds to Camshaft Capital Fund, a move considered suspicious.

- Lack of disclosure regarding potential departures of key management personnel, trading financials, and available capital.

- Breach of Obligations to Shareholders:

- Allegations of deliberate and repeated breaches in reporting information, inspection covenants, and failure to disclose crucial financial details.

- Shareholders seek answers on the lack of information pursuant to inspection rights, observers at board meetings, and limitations on exercising shareholder rights.

- Corporate Governance Lapses:

- Investors demand a performance review process for key figures, including CEO Raveendran, Gokulnath, and Riju Ravindran.

- Seeking status updates on critical matters, including the rights issue, Aakash acquisition terms, and further fundraises.

- Calls for an explanation of steps and measures to improve corporate governance across group companies.

- Board Restructuring and New Leadership:

- Shareholders call for a reconfiguration of the company’s board, including shareholder representation, independent directors, and board committees.

- Requests for the appointment of a chief compliance officer and a senior regulatory affairs official.

- Urgency in appointing new members to the board, including independent directors and shareholder directors.

Legal Battles and Uncertainties: BYJU’S has taken the legal route, moving the Karnataka High Court to invalidate the EGM request. The court granted temporary relief to the Raveendran family, but the EGM is expected to proceed. Any resolutions passed at the EGM cannot be ratified until the next court hearing scheduled for March 13, 2024.

Potential Impact: The outcome of the EGM could reshape BYJU’S significantly, with possible changes in leadership, board structure, and corporate governance. As one of the pillars of India’s startup and tech narrative, any transformation in BYJU’S could send shockwaves across the entire startup ecosystem.

Stay tuned for further updates on this evolving situation as BYJU’S navigates through these challenging times.

ALSO READ : Do You Know These 20 Ways to Make Money Online and Offline