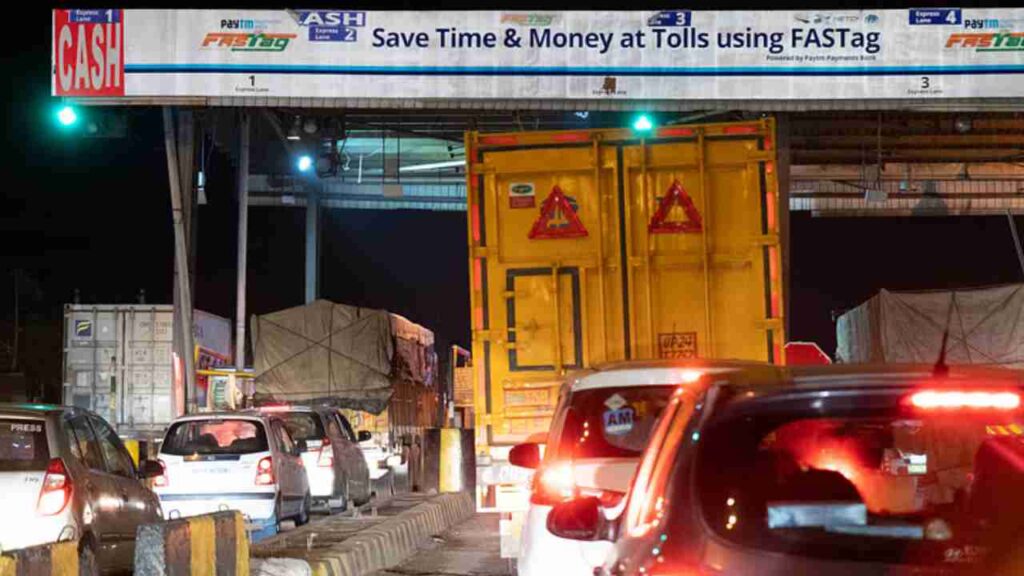

Paytm Invalid for FASTag : NHAI says – In recent times, the landscape of FASTag services in India has witnessed significant changes orchestrated by the National Highways Authority of India (NHAI). These modifications primarily involve alterations to the list of authorized banks for issuing FASTags. Concurrently, Paytm Payments Bank (PPBL) has been subjected to regulatory actions, impacting its role in FASTag services. This article endeavors to provide an in-depth exploration of these developments, offering readers a comprehensive overview and guiding them through the steps necessary to ensure smooth FASTag transactions.

Paytm Invalid for FASTag : NHAI says

-

Paytm’s Removal from Authorized Banks:

The NHAI’s decision to declare Paytm invalid for FASTag purchases is rooted in persistent non-compliances and ongoing material supervisory concerns. Consequently, Paytm FASTags will cease to be operational after the 29th of February 2024. NHAI strongly recommends users to surrender their existing Paytm FASTags and procure new ones from the list of 32 authorized banks provided below.

This move is not merely a procedural change but a strategic realignment aimed at enhancing the robustness and reliability of the FASTag system. NHAI’s commitment to maintaining a secure and efficient toll collection system underscores the significance of this decision.

-

RBI Directive to Paytm Payments Bank:

On the 31st of January, the Reserve Bank of India (RBI) issued a directive specifically addressed to Paytm Payments Bank. This directive explicitly instructed Paytm Payments Bank to discontinue the acceptance of deposits or top-ups in client wallets, FASTags, accounts, or other devices beyond the 29th of February.

Customers are encouraged to utilize balances from alternative accounts, such as savings bank accounts, current accounts, prepaid instruments, FASTag, and the National Common Mobility Card. Furthermore, customers retain the flexibility to request refunds, cashback, or interest at any time, ensuring a smooth transition in the wake of these regulatory changes.

This directive from the RBI is a testament to the central bank’s commitment to maintaining the integrity of financial services and ensuring compliance with regulatory standards. The persistent non-compliances and supervisory concerns led to this decisive regulatory action against Paytm Payments Bank.

-

List of Authorized Banks for NHAI FASTags:

Recognizing the necessity for a seamless transition, NHAI has meticulously curated a list of 32 authorized banks for procuring new FASTags. This list includes renowned banking institutions such as State Bank of India, ICICI Bank, HDFC Bank, Airtel Payments Bank, and many more. Users are strongly advised to initiate the ‘Know Your Customer (KYC)’ process for their latest FASTags, aligning with the RBI guidelines.

This list serves as a roadmap for users, ensuring they make informed decisions regarding the transition from Paytm FASTags to those issued by authorized banks. The proactive approach adopted by NHAI aims to minimize disruptions for users and maintain the efficiency of the FASTag system.

-

Refund and Transition Process:

Users currently holding Paytm FASTags are strongly recommended to surrender them before the 29th of February 2024. Obtaining new FASTags from the authorized banks is imperative to ensure uninterrupted travel on national highways. Users can utilize balances from alternative accounts during this transition period.

Furthermore, NHAI assures users that they have the option to request refunds, cashback, or interest at any time. This customer-centric approach aims to mitigate any inconveniences arising from the transition and instill confidence in the revised FASTag ecosystem.

FAQ’S ON FASTAG

Conclusion: Paytm Invalid for FASTag

In navigating these substantial changes to NHAI FASTags, users are encouraged to remain vigilant and informed about the updates. The transition from Paytm FASTags to those issued by authorized banks is not just a procedural shift but a strategic move to enhance the efficiency and compliance of the FASTag system. Adhering to the guidelines provided by NHAI and the Reserve Bank of India will empower users to seamlessly navigate these changes and continue reaping the benefits of FASTag technology. The commitment to a secure, reliable, and efficient toll collection system remains at the forefront of these transformative measures.